price to cash flow from assets formula

Accordingly there are at least two cash flow measures that an analyst can look at and here are their formulas. Cash flow to revenue measures how successfully the company converts its revenue into cash.

Net Cash Flow An Overview Sciencedirect Topics

Price to Operating Cash Flow Current Market Price Operating Cash Flow.

. Once they have these three numbers Johnson Paper Company can calculate their cash flow from assets. 12000 Cash flow generated by operations 10000 earnings 2000 depreciation -25000 Change in. Funds from Operations 100000 200000.

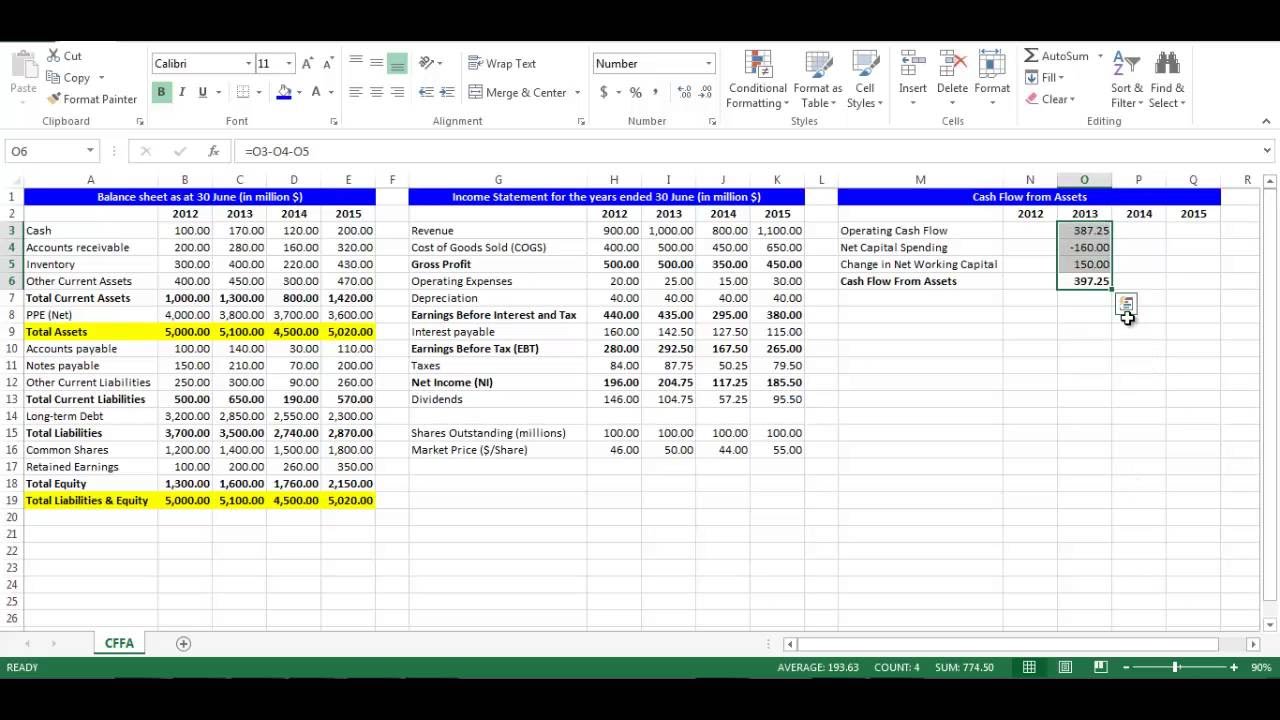

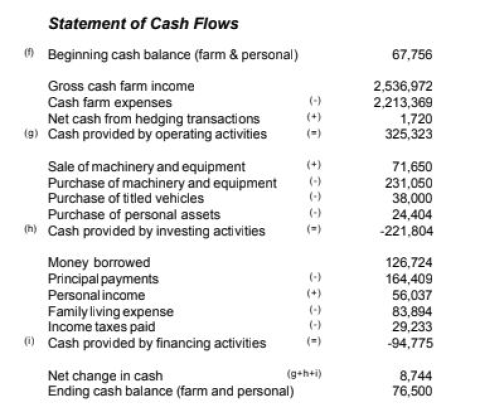

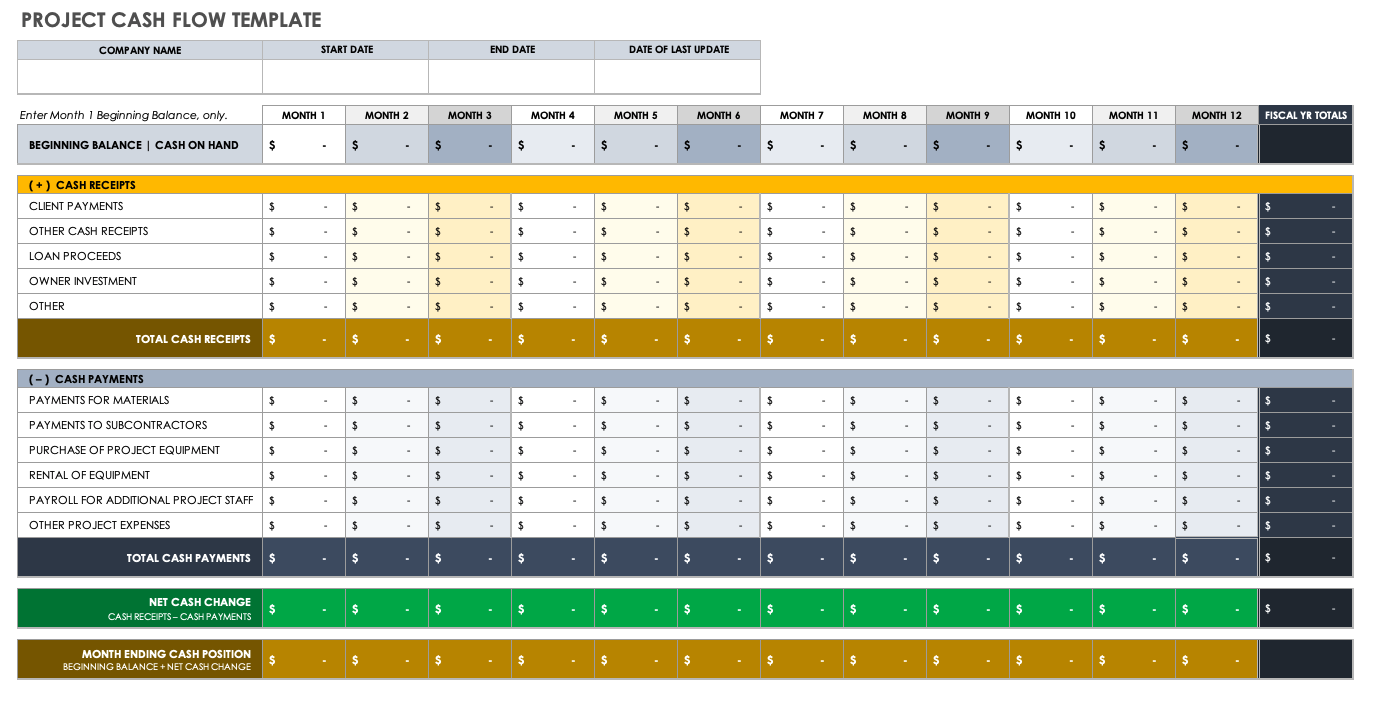

PCF Price per Share Operating Cash Flow per. Cash Flow Cash from operating activities - Cash from investing activities - Cash from financing activities Beginning cash balance. This results in the following cash flow from assets calculation.

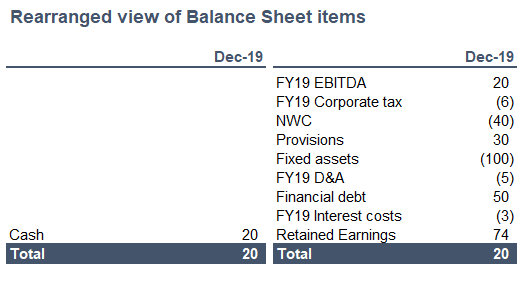

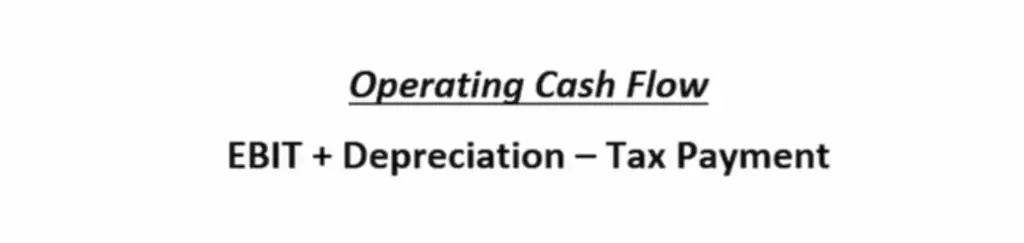

Equation for calculate cash flow from assets is Cash Flow From Assets f - n - w Where f Operating cash flow n Net capitalspending w Changes in net working capital. Cash Flow From Assets f - n - w Where f Operating cash flow n Net capitalspending w Changes in net working capital. Cash flow from assets formula cash flow from operation net working capital change in fixed assets.

Price to Cash flow Ratio Current Stock Price Cash Flow per Share 50 15 333. The Price - Cash Flow Ratio Formula. Its OCF per share is as follows.

Operating Cash Flow Net income Depreciation and amortization Stock-based compensation Other operating expenses and. In case of Frost we need to estimate operating cash flows and then work out PCF as. This calculation of cash.

Cash flow to revenue CFO Revenue. The price to cash flow ratio is calculated by using the following formula. Heres how this formula would work.

Add the three amounts to determine the cash flow from assets. How is the price to cash flow ratio calculated. 200Million100MillionShares2fractext200 Milliontext100 Million Shares 2100MillionShares200Million2 The company t See more.

The formula for the Price to Cash Flows ratio or PCF is a companys market capitalization divided by its cash flows from operations. Funds from Operations Net Income Depreciation Depletion Amortization Deferred Taxes Investment Tax Credit Other Funds. The company has anOCFof 200 million in a given year.

Price-to-Cash Flow PCF. Alternatively PCF can be calculated on a per-share basis in which the latest closing share price is divided by the operating cash flow per share. Consider a company with a share price of 10 and 100 million shares outstanding.

CFFA 20000 -8000 -2000 10000. The detailed operating cash flow formula is. A higher ratio is preferable because.

How To Calculate Initial Investment Operating Cash Flow Terminal Cash Flow For Capital Budgeting Youtube

Formula Sheet Lecture Notes 1 Formula Sheet Cash Flows Operating Cash Flow Ocf Ebit Studocu

Price To Cash Flow Ratio Formula Example Calculation Analysis

Disposal Of Assets Disposal Of Assets Accountingcoach

Cash Flow From Assets Using Excel Youtube

Cash Flow Formula How To Calculate Cash Flow With Examples

How Does Depreciation Affect Cash Flow Gocardless

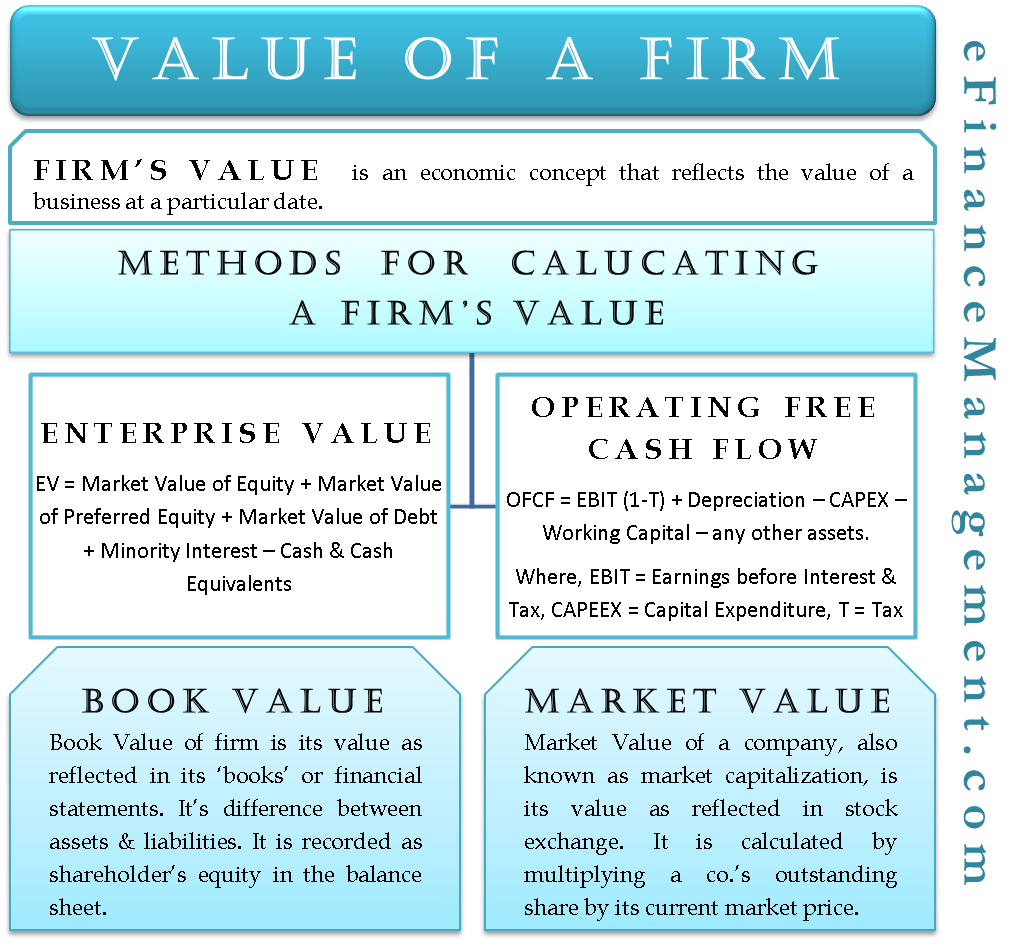

Value Of A Firm Definition Calculations Formula Efinancemanagement

Cash Flow From Assets Definition And Formula Bookstime

Price To Cash Flow P Cf Formula And Ratio Calculation

Discounted Cash Flow Wikipedia

Cash Flow From Operations Formula Calculator Excel Template

Cash Flow From Assets Definition And Formula Bookstime

How To Calculate The Cash Flow From Investing Activities

Project Based Cash Flow Analysis Guide Smartsheet

Price To Cash Flow Formula Example Calculate P Cf Ratio

What Is Cash Flow Formula And How To Calculate It

Cash Flow Analysis Basics Benefits And How To Do It Netsuite